Spanish VAT compliance upgrade, Amazon FBA function restricted warning!

Recently, Amazon has issued an important notice to its sellers regarding compliance with Spanish VAT regulations.

According to the notice, if the seller fails to provide a valid EU tax number, they will face the risk of having their store or FBA functionality restricted. I will provide you with a detailed explanation of this change and offer professional coping strategies.

In Spain, enterprises typically need to apply for two tax codes: one is the local tax code, and the other is the EU tax code.

1. National Insurance Fund (NIF)

Número de Identificación Fiscal(NIF) is a tax identification number in Spain, serving as the sole identifier for businesses or individuals to register for tax purposes in the country. When selling products in Spain, sellers must apply for a NIF from the Spanish Tax Agency for customs clearance and tax filing.

2. EU VAT number (ROI)

Registro de Operadores Intracomunitarios(ROI) is a Spanish EU VAT number that allows businesses to conduct tax-free B2B transactions within the EU. After applying for a ROI, businesses can engage in tax-free transactions within the EU and automatically issue invoices on the platform. Cross-border B2B orders are eligible for a 0% VAT rate.

The EU tax number in Spain is a tax number used for transactions and tax payments within the EU, ensuring that sellers can legally declare when conducting business activities within the EU. The EU tax number usually starts with "ES" followed by the local tax number in Spain, so the EU tax number needs to be applied for after having a local tax number.

Within the EU, businesses and individual operators engaged in cross-border B2B transactions are required to apply for a VAT EU tax number.

How to determine whether you possess a Spanish EU tax identification number?

Companies with EU tax identification numbers (TINs) will have records in the ROI EU operator registration and census system. They can verify through the VIES value-added tax information exchange system whether they have registered an EU TIN and whether their transactions meet the requirements for VAT exemption.

Coping strategies:

1. Obtain a valid EU tax number for Spain as soon as possible

If you do not yet possess a valid EU tax number, we recommend that you promptly consult with a professional advisor (such as Zhuoxi Cross-border) to acquire and register a valid Spanish EU tax number.

2. Update tax information in a timely manner

Ensure that the tax information in your Amazon account is up-to-date and matches your actual tax status.

3. Pay attention to notifications from Amazon

Amazon will communicate with sellers through account status, performance notifications on the control panel, or the operation panel.

Tax compliance is crucial for the success of cross-border e-commerce. In light of Amazon's upgraded VAT compliance requirements in Spain, we recommend that you take prompt action to ensure that your account and business remain unaffected.

Spanish VAT compliance upgrade

Spanish VAT compliance upgrade

EU Battery Law Coming into Eff

EU Battery Law Coming into Eff

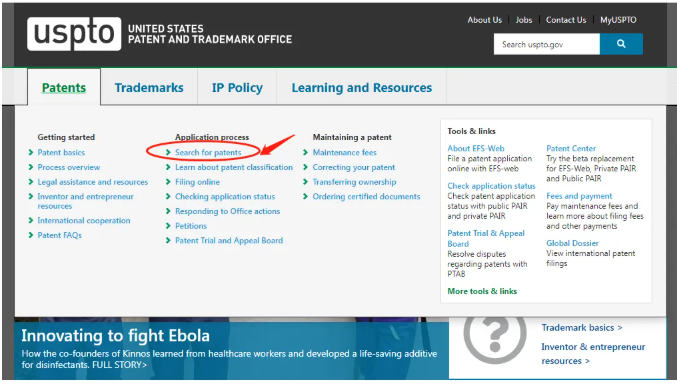

U.S. Appearance Patent Search

U.S. Appearance Patent Search

Over 60,000 monthly sales! Ama

Over 60,000 monthly sales! Ama